I recently began shifting more of our cash from a high-yield savings account to our taxable brokerage. We have maintained a fairly high savings rate over the last couple of years which allowed our cash balance to swell, but the time had come to move into higher return products.

Because interest rates on high-yield savings accounts have been so high, there was no need to rush a decision on allocating the funds. Growing the balance to pay our mortgage off early or buying real estate for investment were two good options.

Ultimately, I knew action would trump inaction when seeking to maximize earning potential. I concluded that a hybrid approach was best for our situation and started to slowly shift more cash into equities. That way, the cash balance wouldn’t become too large, but it would remain big enough (as we continue to save) to act on buying opportunities (like an attractive real estate opportunity).

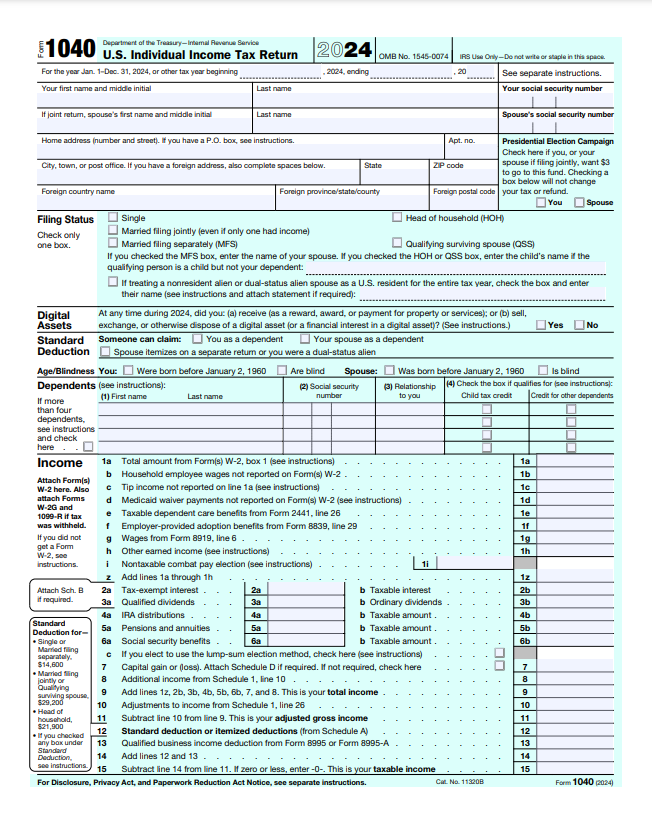

In addition to the potential for higher returns, I realized I was also reducing our tax burden in the present. By moving from cash producing 4%+ to an S&P 500 ETF with a dividend yield of less than 1.5%, we would be paying less in taxes.

The reason is simple: bank interest is taxed as ordinary income and therefore subject to our household’s marginal income tax bracket, while qualified dividends from the S&P 500 ETF would be taxed at either 0%, 15% or 20% depending on household income. For us, it would be 15%, assuming that we also meet the holding period rule.

So not only are we receiving less taxable dividends than taxable interest, but the tax rate applied to the dividends is lower than the tax rate applied to the interest. Below is a breakdown of the tax implications for $100k in a savings account compared to $100k in an S&P 500 ETF. This assumes a 24% marginal tax rate.

| HYSA (4% Interest) | S&P 500 ETF (1.5% Dividend Yield) | |

| Annual Yield / Interest | $4,000 | $1,500 |

| Tax Rate | 24% (ordinary income) | 15% (qualified dividend) |

| Taxes Owed | $960 | $225 |

| After-Tax Income | $3,040 | $1,275 |

Of course, our objective is important to reiterate here. Going from cash to equities is a long-term strategic move, and we wouldn’t invest money that we expect to need in the next several years. While the after-tax income from the savings account still beats the S&P 500 ETF, we are expecting significant appreciation in the ETF shares over a multi-decade time horizon.

When we do eventually sell the ETF shares, we would owe applicable capital gains taxes for that appreciation. That is, hopefully, many years from now!

Discover more from The Budget Brainiac

Subscribe to get the latest posts sent to your email.